More About Most Accurate Credit Score App

Wiki Article

Things about Which Credit Bureau Is Most Accurate

Table of ContentsSome Known Details About Does Child Support Affect Your Credit Score Which Credit Bureau Is Most Accurate for BeginnersEverything about Is Experian More Accurate Than Credit KarmaUnknown Facts About Most Accurate Credit Score7 Simple Techniques For Is Experian More Accurate Than Credit Karma

In comparison, financial debt negotiation as well as credit scores therapy are debt alleviation choices concentrated on assisting individuals stay clear of personal bankruptcy and also settle their financial debt, completely yet with a possibly reduced interest rate (credit scores counseling) or for a lowered quantity (financial debt settlement). The key differences in between financial obligation negotiation vs. credit score fixing vs.Nonetheless, the procedure can be taxing, especially if there are great deals of mistakes. Debt fixing firms can relieve the concern by doing this help you. If you just require to deal with one or two straightforward credit score reporting mistakes (e. g., your creditor forgot to note among your financial obligations as paid completely), you'll conserve money by working directly with your lender to deal with the issue.

The 3-Minute Rule for Which Credit Score Is Most Accurate

See to it to evaluate the strategy documents before you register to understand the fee structure and also the services you'll receive. Total the documents required to sign up in the program (e. g., submit an application) and pay any type of charges as they come due (e. g., registration or arrangement costs, monthly charges, and so on).

g - https://dli.nkut.edu.tw/community/viewtopic.php?CID=17&Topic_ID=19639., credit monitoring, number of disagreements, and so on) (which credit score is most accurate). Several of the variables to consider consist of: After providing you with a cost-free assessment, the majority of debt repair service business charge an in advance arrangement or enrollment cost. This fee is planned to cover the preliminary work needed for the business to begin fixing your credit report issues.

Not known Factual Statements About Can A Credit Repair Company Remove Student Loans

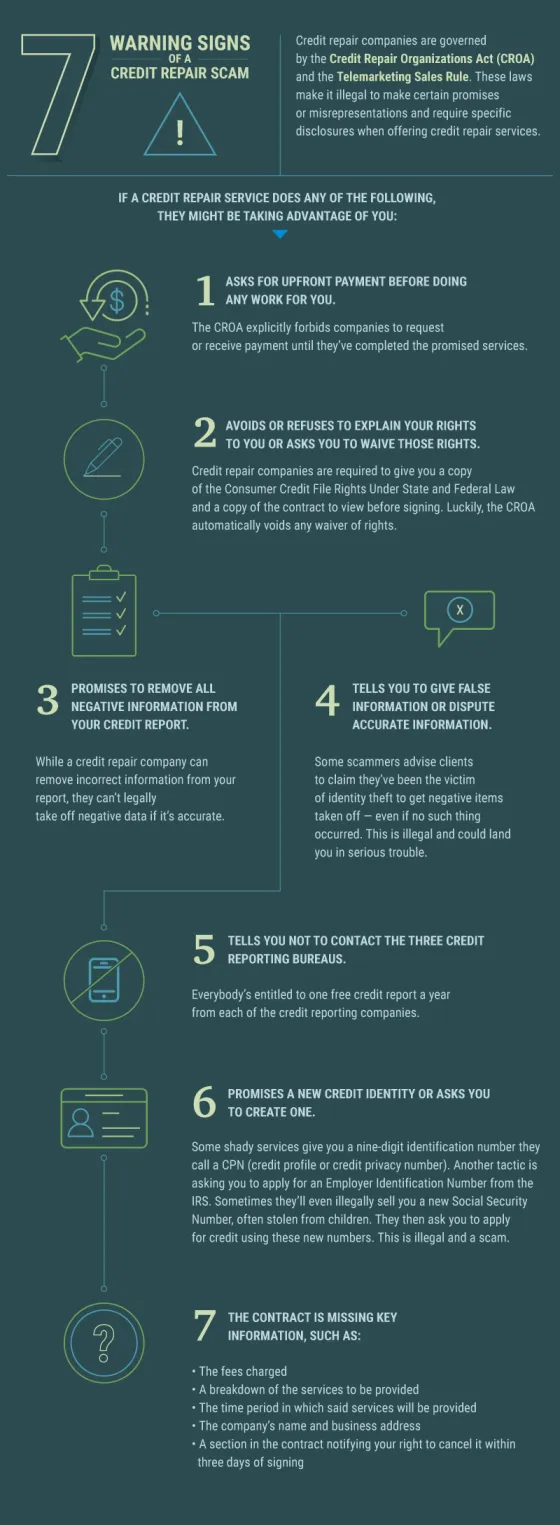

Before joining a debt repair service company, you should constantly do your homework. Start by making a checklist of recognized companies. Look for complaints in the Consumer Financial Security Bureau data source. After tightening down your listing, you can interview each company before deciding. According to the Federal Trade Commission, there are a number of signs of fraudulence to enjoy for: Asks for huge amounts of cash upfront, Prevents you from calling the credit scores reporting agencies yourself, Says to dispute right items on your credit history recordsMotivates incorrect information on debt or financing applications, Avoids over your lawful rights when clarifying the company's services, The Credit rating Fixing Organizations Act (CROA) says you deserve to cancel a contract within 3 days of signing for any kind of reason.

For several years, credit history fixing business have actually had a credibility for charging high costs without aiding customers and occasionally causing even worse economic distress. But Ulzheimer says the 1996 government Credit Repair service Organizations Act established policies for these kinds of solutions, and self-policing by the debt repair solutions profession organization assisted cleanse up the market.

The Of Which Credit Bureau Is Most Accurate

At the same time, Bruce Mc, Clary, vice president of interactions for the National Structure for Credit rating Counseling, states it's still crucial to do your research regarding whether credit history fixing services are your best option and, if so, which business will do the finest work. "I lately saw a pickup truck parked in a shopping center with signs all over it that said, 'Required aid with your credit rating?Suggest they can get rid of legitimate adverse details. You intend to avoid collaborating with a company that does anything unlawful on your behalf, claims Mc, Clary. Ask you to exist. Asking you to make a misleading declaration concerning details on your credit record is an outright infraction of CROA, says Ulzheimer - can a credit repair company remove student loans.

If you work with a credit scores repair work solution, you'll review each credit score report with an agent from the company and give paperwork that supports your conflict, such as paid invoices or court documents. Be prepared to answer questions regarding your credit rating often throughout the credit scores repair work process."A lot of authentic blunders can be dealt with by individuals, such as a clinical expense that you have actually paid that hasn't been reported as paid completely," states Warren.

The Definitive Guide for Most Accurate Credit Score App

If a bill that went to collections was marketed to an additional financial debt collection agency and also your debt report incorrectly shows the exact same past due equilibrium numerous times, you can request the credit history bureau fix it. https://www.directorysection.com/author/strtyrcrdtrp/. Bear in mind that some genuine defamatory info, like bankruptcies and accounts sent out to collections, will remain on your debt record for as long as seven to 10 years.

When examining out debt repair service companies, Warren recommends asking if they have actually fixed situations similar to what you're encountering, such as eliminating a credit history record mistake. Describe your alternatives. You require to comprehend your choice if your objectives are not achieved, states Mc, Clary. Deal a performance service warranty. Warren states business ought to offer a guarantee on their efficiency that states they won't charge you if they can't eliminate a particular number of disputed items on the credit history report.

"Constantly inspect that a business is certified, bonded Learn More Here and guaranteed," claims Warren. One more note of caution for customers: "Read all the disclosures in the agreement, and also do not set up an auto-deduct repayment plan," says Warren. "It's far better to supply postdated checks so you have extra control over your cash."If you prefer not to do your own credit rating repair work, another choice is to function with a nonprofit credit history counselor.

Report this wiki page